Neo Banks

Gradually, Neobanking is becoming a buzzword in the financial tech, often called, Fintech Community. This term has gained its momentum since it is been taking the headline on the media and news. But, do we have insights on what it is all about.

On a global level, the fintech industry is taken on a storm by Neobanks. We have been witnessing news players in the market every day whose primary aim is to simplify finance and services to a great extent. Now let us have a look on neobank in detail.

What are Neo Banks ?

A neobank is a tpe of digital bank that does not have any branches. Rather than being on a physical location, it is present entirely online.

We can imagine it as a wide umbrella of financial service providers who serve todays tech savvy customers. Neobanks can also be termed as fintech firms that provide mobile friendly and digital solutions payments and money lending. Money transfers and more. These banks don't posses their own bank license but count on banking partners to provide them with licensed services of the bank.

As the financial landscape is taking a turn towards customer satisfaction and experience, a gap has emerged from what the traditional bank offer to what are the expectations of customers. Neo banks have taken a step forwards to make an attempt to fill this gap. A great number of traditional banks are bogged down by their legacy-based infrastructure. So, they collapse when it comes to providing aid to SMEs with finance services like providing as invoicing software, a payment gateway, multiple aspects of cash management, among others.

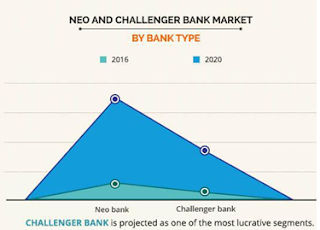

This above mentioned disparity, along with the wide spread explosion of technology, it only makes sense than financial services can coalesce with the other banking services. These banks are also called "Challenger Banks". These are newly introduced but have already registered a CAGR of around 50% between 2016-2020 and are constantly redefining the approach in the banking industry.

The Workings

Unlike

traditional banking system, neobanks

posses a completely different business model. But, like our traditional banks neobanks

do make money from margins between money lending and inflow. Since, as we

talked about, they don’t have any physical location as they are completely

online, the customer transaction and other fees are slashed by a significant

amount. Because they are customer centric, they help us with personalized

services that are fired up via technology.

Decision

making process of a neobank

are data drive decisions. Since these platforms are also very simplified and

modernized, it becomes easier for the banks to collect, examine and analyze

data and understand in what way their customers behave in the neobanking

ecosystem. Based upon these

observations, they form units of customers based on their action rather than

sticking to few data points. Also the government has made

it extremely simple to get a banking license by

opening doors

for startups to innovate.

Advantages of Neo Banking

As

neobanks

are digital and mobile friendly platform, they open up a wide umbrella of

advantages available to a customer. Here we will talk about some key points :

- Hassle free Account Creation : We all are fully aware of the difficulties we need to face to open an account. The process may not be as complicated as before, but the hiccups aren’t fully gone. These tedious process is now completely vanished while creating an account with a neobank.

- Seamless International Payments : If we talk about traditional banks, it is not always that we are given a debit card that can be used anywhere across the globe, on transact internationally. Mostly we have to ask for an upgrade. But with neobanks, we don’t have to worry about the same. We can easily make purchase while being abroad, with current exchange rates.

- User Friendly Interface : Neobanks are providing all people out there an excellent customer experience. This also means one don’t have to go through or work in a glitch net banking site anymore. The apps are a lot more clean, user friendly and crisp. They are well designed and highly responsive.

- Smart Reporting : Neobank transactions are immediate and instant. The transaction details are provided instantly, with up to date balance at all time. All the undertaken transaction and payment appear on a panel in app and one doesn’t have to go elsewhere for this info. There apps also provide us with an overview of our expenditure along with some interesting saving goals.

Neobanks and Business

Till

now, We talked about how much it affects the customers, but now let us

understand how the traders or businesses can make the most of it. Business

often have to deal with tedious process involving disbursals and payments.

Often, one ends up spending hours on manual work each month because of too many

buggy software and complex infrastructure.

With

neobanks,

one get to accelerate, Supercharge and simplify every aspect of ones financial

operations ! From managing cash flows and accepting payments to flexible

payouts and reconciling transactions. Some benefits are :

- One ends up saving 15x time

- Provide an excellent customer experience

- Access to a unified platform

- Manage and track money movements

Neobanks and its Global Funding Stats

2019

Q1 has witnessed $2.5b

in

funding across

55

deals

approx. This

has surpassed

the

full-year figures at

$2.3b of 2018 indicating that

investor momentum continues in full swing.

Europe and LatAm

are

the leaders by region.

Other

markets

like

United States are

rapidly catching up. In 2018 neobanks

in United

States got 10x funding

as in 2015

and 4x

funding than 2017 according

to

CB Insights. The opportunity is great

and

spilling beyond

Europe and US. Judo,

an

SME neobank

raised around $365m

to become the largest funded player

(Private) in Australia.

Comments

Post a Comment